The Ultimate Guide To Clark Wealth Partners

Wiki Article

See This Report about Clark Wealth Partners

Table of ContentsNot known Details About Clark Wealth Partners Little Known Facts About Clark Wealth Partners.Unknown Facts About Clark Wealth PartnersLittle Known Questions About Clark Wealth Partners.All About Clark Wealth PartnersClark Wealth Partners - An OverviewThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutHow Clark Wealth Partners can Save You Time, Stress, and Money.

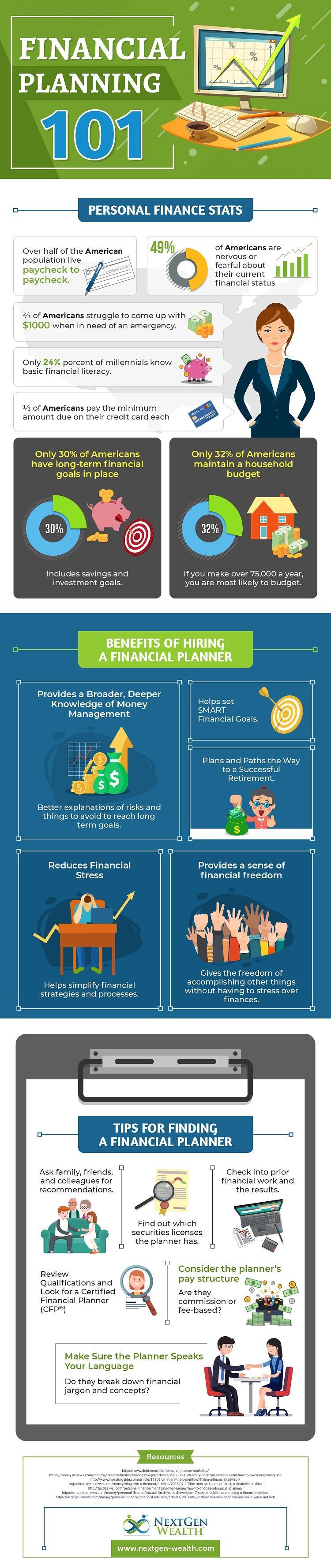

Typical reasons to take into consideration an economic expert are: If your financial situation has become more intricate, or you do not have self-confidence in your money-managing abilities. Conserving or browsing significant life occasions like marriage, separation, kids, inheritance, or work modification that might dramatically impact your economic scenario. Navigating the change from conserving for retirement to maintaining wide range throughout retirement and just how to create a strong retired life revenue plan.New technology has actually resulted in even more comprehensive automated financial devices, like robo-advisors. It depends on you to examine and figure out the ideal fit - https://penzu.com/p/10bc905112757bff. Inevitably, a good financial consultant ought to be as conscious of your investments as they are with their very own, staying clear of too much charges, conserving cash on taxes, and being as clear as possible regarding your gains and losses

The Definitive Guide to Clark Wealth Partners

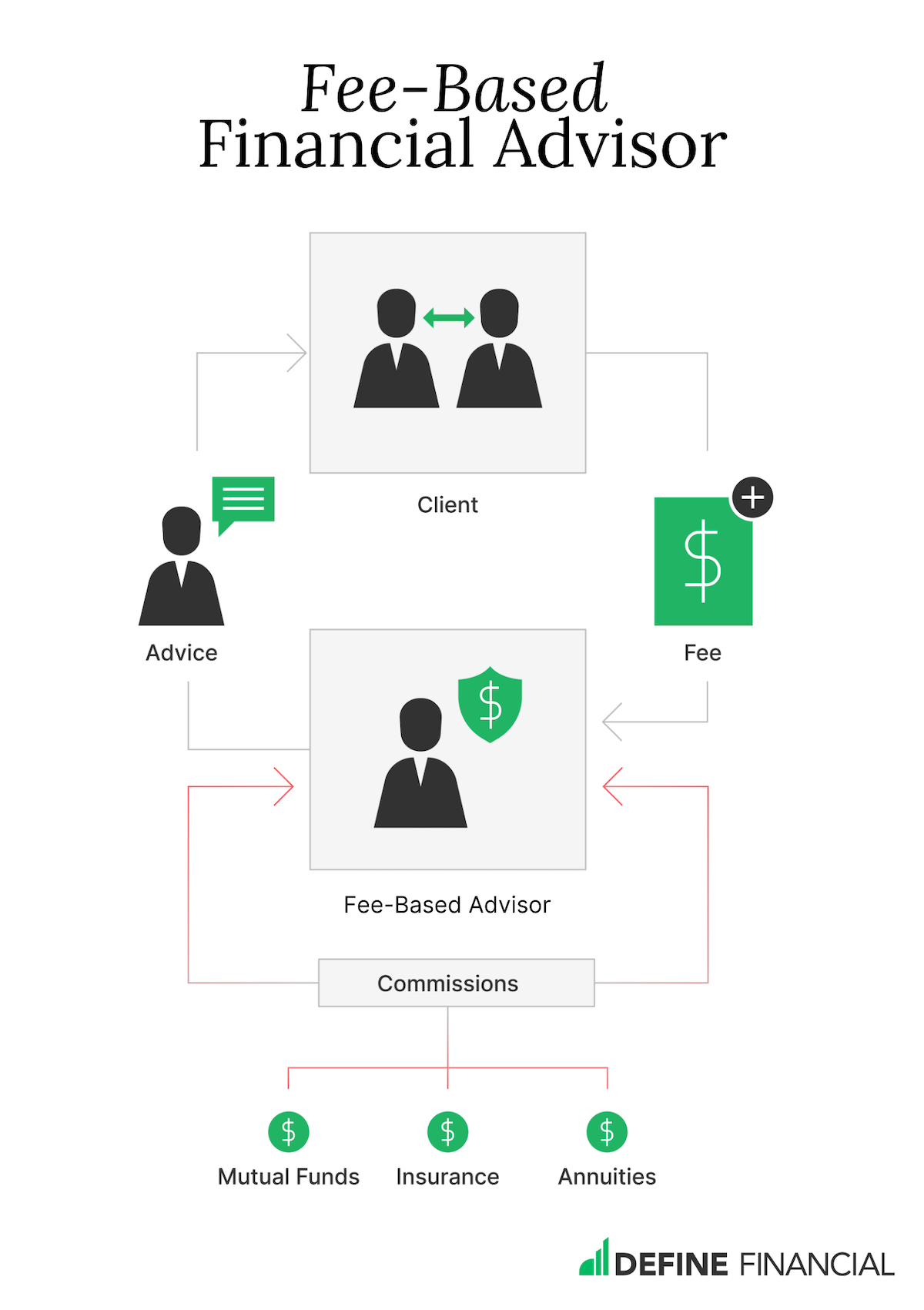

Gaining a compensation on item referrals doesn't necessarily indicate your fee-based expert functions versus your ideal interests. They might be a lot more likely to suggest products and services on which they earn a compensation, which may or may not be in your ideal passion. A fiduciary is lawfully bound to place their client's interests.They may comply with a loosely checked "suitability" standard if they're not registered fiduciaries. This conventional allows them to make referrals for financial investments and solutions as long as they suit their client's goals, danger resistance, and financial circumstance. This can convert to suggestions that will certainly additionally gain them cash. On the other hand, fiduciary advisors are legally obligated to act in their client's benefit as opposed to their own.

4 Easy Facts About Clark Wealth Partners Shown

ExperienceTessa reported on all points investing deep-diving right into complicated economic subjects, losing light on lesser-known financial investment opportunities, and discovering means viewers can work the system to their benefit. As a personal finance expert in her 20s, Tessa is really knowledgeable about the influences time and uncertainty carry your financial investment decisions.

It was a targeted promotion, and it functioned. Review more Read much less.

9 Easy Facts About Clark Wealth Partners Shown

There's no solitary route to becoming one, with some people beginning in financial or insurance, while others begin in accounting. A four-year level gives a strong foundation for professions in investments, budgeting, and client solutions.

The Single Strategy To Use For Clark Wealth Partners

Typical instances include the FINRA Series 7 and Collection 65 exams for safeties, or a state-issued insurance policy permit for offering life or wellness insurance coverage. While qualifications might not be legitimately required for all intending duties, companies and customers frequently see them as a benchmark of professionalism. We look at optional qualifications in the next section.Most economic organizers have 1-3 years of experience and experience with monetary products, compliance criteria, and direct client communication. A solid academic background is important, however experience shows the capability to apply theory in real-world settings. Some programs integrate both, enabling you to complete coursework while earning monitored hours through teaching fellowships and practicums.

Clark Wealth Partners Things To Know Before You Get This

Very early years can bring lengthy hours, stress to build a customer base, and the requirement to continually show your proficiency. Financial coordinators delight in the opportunity to work carefully with customers, guide crucial life decisions, and typically attain adaptability in timetables or self-employment.

Wealth supervisors can boost their incomes with compensations, property fees, and performance rewards. Economic supervisors supervise a group of financial coordinators and advisors, establishing departmental strategy, taking care of compliance, budgeting, and directing inner operations. They spent much less time on the client-facing side of the market. Nearly all economic managers hold a bachelor's degree, and numerous have an MBA or comparable graduate degree.

The Best Strategy To Use For Clark Wealth Partners

Optional accreditations, such as the CFP, usually call for added coursework and screening, which can extend the timeline by a number of years. According to the Bureau of Labor Statistics, individual economic experts make a typical yearly yearly salary of $102,140, with top income earners gaining over $239,000.In various other districts, there are laws that need them to satisfy certain needs to utilize the financial consultant or financial coordinator titles (financial planner in ofallon illinois). What establishes see this site some financial advisors apart from others are education, training, experience and certifications. There are lots of designations for economic advisors. For monetary coordinators, there are 3 usual designations: Licensed, Personal and Registered Financial Organizer.

The Only Guide for Clark Wealth Partners

Where to locate a financial consultant will depend on the type of guidance you require. These organizations have personnel who may assist you recognize and get certain kinds of financial investments.Report this wiki page